In yesterday’s post (Tide is Turning for the Aussie), I explained how a prevailing sense of uncertainty in the markets has manifested itself in the form of a declining Australian Dollar. With today’s post, I’d like to carry that argument forward to the Canadian Dollar.

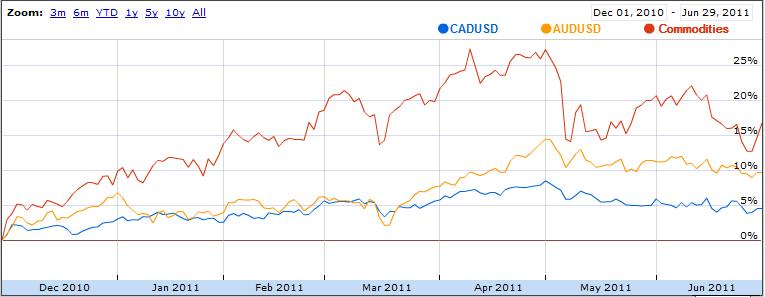

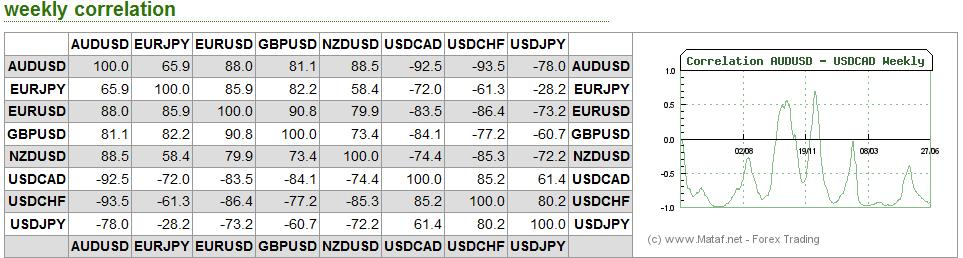

As it turns out, the forex markets are currently treating the Loonie and the Aussie as inseparable. According to Mataf.net, the AUD/USD and CAD/USD are trading with a 92.5% correlation, the second highest in forex (behind only the CHFUSD and AUDUSD). The fact that the two have been numerically correlated (see chart below) for the better part of 2011 can also be discerned with a cursory glance at the charts above.

Why is this the case? As it turns out, there are a handful of reasons. First of all, both have earned the dubious characterization of “commodity currency,” which basically means that a rise in commodity prices is matched by a proportionate appreciation in the Aussie and Loonie, relative to the US dollar. You can see from the chart above that the year-long commodities boom and sudden drop corresponded with similar movement in commodity currencies. Likewise, yesterday’s rally coincided with the biggest one-day rise in the Canadian Dollar in the year-to-date.

Beyond this, both currencies are seen as attractive proxies for risk. Even though the chaos in the eurozone has very little actual connection to the Loonie and Aussie (which are fiscally sound, geographically distinct, and economically insulated from the crisis), the two currencies have recently taken their cues from political developments in Greece, of all things. Given the heightened sensitivity to risk that has arisen both from the sovereign debt crisis and global economic slowdown, it’s no surprise that investors have responded cautiously by unwinding bets on the Canadian dollar.

ليست هناك تعليقات:

إرسال تعليق